Back when I was still a new employee, at the age of 21, my main goal was to save for emergency fund, a retirement fund and my own house. I filled my days with working hours to be able to save up early and enjoy my life afterwards. I worked as much as 15 hours a day, 7 days a week just to reach my goal. After about 4 years, I saved enough for my emergency and retirement fund and my house was complete. Because I worked so hard, I got promoted plenty of times I had more than enough salary. I spend for everything I can think of: expensive accessories, branded bags, shoes, dining out at restaurants and a lot more. It came to a point where I almost lost my emergency fund because I was too wasteful with my money. That was when I realized, I needed to have another investment to grow my money in, not waste them. But there are a lot of options out there it is actually hard to decide which one is best for me.

If you are like me who have decided to have an investment but was overwhelmed by the choices, worry no more. In this article you will learn how and where to invest base on your preference.

The first thing you will need to do is answer this questions:

1. How much money can you invest?

To be able to determine which is the best investment option for you, you need to know how much are you willing to invest. Take note, you cannot use your emergency fund for investment. As much as possible, don’t take out a loan. The best way is to determine how much is your total savings and subtract your emergency fund. That should be your investment fund.

Bear in mind that you should also be able to have afford your living expenses. Do not put them all in your investment as it takes time for your money to grow.

2. How long can you keep your money invested?

Now that you have determined how much money you can invest in, we would need to know how long you can afford to keep it in an investment. It is advisable to keep your investment for at least 10 years. More is always better. If you can also put in additional money or new investment every year, that would also be better.

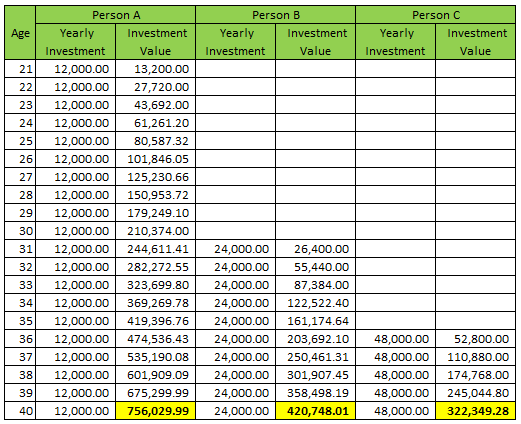

To give you some figures, see the illustration below. 21-year old person A decided to save P1,000 every month to put into an investment at the end of the year. 31-year old person B got into investment a bit late and decided to put in P2,000 every month for an investment. 36-year old person C started very late he decided to allocate P3,000 every month. Assuming all investments has an equal interest of 10%, we have calculated the value of their money when they reach the age of 40. Person A, B and C all put in a total of 240,000 and all got an annual interest of 10% per annum. Person A got P756,000 which is almost twice as what Person B got and more than twice with what Person C got. The only difference they had was time, but look at the outcome.

3. How much effort can you put into managing your investment?

Aside from money and time, you will also need to know how much effort you can put into managing your investments. If you don’t have a lot of time, there are a lot of Investment Managers who can do it for you but you will be paying a lot of fees.

The better option would be doing it yourself. You can see a lot of potential from your money and can easily adjust from one investment to another whatever you see fit. You might even find other investment options your manager did not tell you.

4. How much risk are you willing to take?

If you have searched the internet for some investment advice, you probably have read that if you want bigger return, you must take higher risk. If done carelessly, you might lose all your money instead of the big return expectation. You can also opt for a lower risk but of course, low return of money. Remember, there is no such thing as risk-free investment. If you’ve heard one, run away from it. That is probably a scam.

There is no definite formula or strategy to be able to determine which path you would take. It is always a balancing act between risk and rewards. If you can afford it, try to diversify your portfolio between low to high risk investments. If you are starting out, probably start small.

Main Investment Options in the Philippines

Now that you have answered the questions above, it is now time to decide which investment option you would take.

Time Deposit

Time deposit are very much like savings deposit. The only difference is you can’t withdraw your time deposit for a specific amount of time. And it also has a slightly higher interest rate than savings.

- Minimum Investment: Low. Depending on the bank you want to put your money into, time deposit can be as low as P1,000, but it would be better to put more money so can actually feel the amount or return.

- Investment Period: Short. You can get a time deposit for as short as 30 days but banks will give you a higher interest rate if you invest it for a longer period.

- Maintenance: Low. This is for extremely conservative investors who are looking to keep their money from being spent while earning a little interest.

- Risk and Return: Low. The risk of investing in a time deposit is close to nothing. Same can be said with the return especially if you are putting in only a small amount. Banks give as low as 0.25% interest rates per annum for your time deposit. That is equivalent to 0.02% for every month.

Bonds

When you buy bonds, you will know exactly how long you need to wait and there is a guaranteed rate of return. Just make sure that you can leave the money invested for the entire maturity period, because pulling out the investments early will mean losing money.

- Minimum Investment: Low. Retail treasury bonds can be availed for as low as P5,000. Some banks may require a larger minimum investments. It might also be beneficial for you to invest in a larger amount since bonds has such low interest rates.

- Investment Period: Long. Bonds usually takes a couple of years of more. Although, this is probably one of the safest investment option one could take.

- Maintenance: Low. Bonds are for non-risk takers who prefer to not lose money than have a bigger return.

- Risk and Return: Low. Whether you’re talking risk or return, bonds will have very low for those. Low risk because you will know exactly how much you will get and when. Low return because it has very low rate of return.

Mutual Funds

Mutual funds operate by pooling together money from many different investors and investing those in various assets and securities. It is easier to manage risk this way.

- Minimum Investment: Low. For as low as P5,000 you can have your own mutual fund investment. Of course, the amount will vary depending on which fund you are looking at.

- Investment Period: Short. The shortest period for mutual fund investment is 90 days. It can give you a lot of moving ground when it comes to deciding whether you want to continue or not. Of course, if you prefer, you can always have it longer than 90 days.

- Maintenance: Low. This is highly recommended for people who have money but can’t put it much effort to make their investment grow.

- Risk and Return: Average. Mutual funds can have low to high risk depending on the type of funds you choose. Generally, professionally managed mutual funds are less risky than doing it on your own.

VUL Insurance

VUL Insurance is one of the most popular in the Philippines because it comes with life insurance, health insurance and mutual funds.

- Minimum Investment: Low. VUL insurance plans are flexible and can only cost a couple of thousands a month. You also can go up depending on your capabilities and preference.

- Investment Period: Long. The minimum period for VUL insurance is 10 years which quite long.

- Maintenance: Low. This is recommended for first time investors who wants an all in package and with easy maintenance.

- Risk and Return: Average. Overall, the risk profile and rate of return for VUL insurance is about average. Although, if you have other preference, they can adjust them accordingly. The best asset in choosing your plan is a good insurance agent.

Stocks

Stocks is for people who you want bigger returns and doesn’t mind higher risk. To learn more about stocks, you can visit our article about the Basics of Stock Market and the Step by Step Guide to sign up.

- Minimum Investment: Low. Nowadays, you can open a stock trading account for as low as P2,500. But if you can afford it, it is recommended to start with P8,000.

- Investment Period: Short. Stocks are very easy to sell making it a liquid investment. But stocks take time before you can start earning substantial returns. If you need money and would have to sell your stocks, you might be earning at a loss.

- Maintenance: Average. Stock market is for people who want bigger returns even with higher risk and can dedicate a significant amount of time to manage their portfolio.

- Risk and Return: High. Investing in stock carries a lot more risk than mutual funds and VUL. You won’t have the help of professionals in managing your investment. If also have significantly lower funds so it is harder for you to diversify your portfolio. On the brigher side, if you do manage it well, there is a greater chance of collecting bigger returns.

Businesses

Having your own business does sound more controllable than other investment options, but it is not for everyone.

- Minimum Investment: Average. There is no fix amount that we can suggest for a business. It always varies on the type of business you want to do. It can be a few thousands or a few millions. Just remember, before starting a business, make sure you will also take into consideration that your sales might not be enough to cover your operational expenses for 6 months to a year, depending on the industry you’re in.

- Investment Period: Flexible. The rate of return is dependent on two things: the type of business you are in, and how well you sales is doing.

- Maintenance: High. Starting a business is not for faint-hearted people. It takes a lot of guts, motivation and hard work for your business to pay off. Do this only when you are determined to do whatever it takes to succeed.

- Risk and Return: High. This is one of the riskiest investment one could make. It takes a lot of effort to start it, and even more effort to keep it running until you collect some profit. But once you have perseverance and the will to continue no matter what challenges you face, then this will prove to be the best investment you have ever made.

Real Estate

Condominium units and land are the two most popular real estate here in the Philippines. You can either have it rented, or flip it for a higher profit.

- Minimum Investment: High. Real estate investment will cost you at least a few hundred thousand pesos. Prime properties will cost millions. You need to have a lot of money and patience if you want to invest in real estate.

- Investment Period: Long. Real estate is not a liquid investment. It will take time before you see return on your money, much more if you rent it out. At a minimum, you would need to hold your property for at least 10 years before you can start seeing returns.

- Maintenance: Average. This investment takes some effort to maintain and is only for those who are looking to diversify their portfolio.

- Risk and Return: High. This is a high risk high reward type of investment. Cashing out a million for an investment is quite high a risk not to mention that the real estate trend is not always performing better. Make sure to do your research before investing.

Whatever you choose, at the end of the day, the most important part is that you feel good and satisfied with your investment. Along the way, you will lose some money. But if you keep trying, you will eventually learn what investment strategy best suits you and at the same will grow your money at the rate you are satisfied with.

Be the first to comment