Salary and calamity loans are offered to private employees in the Philippines by the Social Security System, or the social insurance program. Calamity loans can be obtained if they live in an area declared to have suffered from natural calamities, while Salary loans depend on the monthly wage of employees.

If you are interested in applying, here is how to apply for a salary loan from SSS. Before applying, make sure you meet the qualifications and prepare the necessary requirements.

QUALIFICATIONS

Before the month of filing or 72 recorded monthly contributions, a borrower or member must have 36 monthly contributions if you plan to file for a two-month loan. Your employer must have up-to-date loan remittances and monthly contributions on your SSS account if you are employed. Also, you must have up-to-date payments of other loans acquired such as housing loans from the Unified Home Lending Program or UHLP.

Use personal loan calculators and SSS Salary Loan available online to know how much you can borrow or simple visit their website to know how much loan you can avail from them. You can treat SSS Salary Loan as your personal loan from the government.

STEPS IN APPLYING FOR A SALARY LOAN

The Social Security System offer two ways to apply a Salary Loan. First one is visiting an SSS branch and the other one is your salary loan application at the My.SSS on their website.

Visiting an SSS Branch

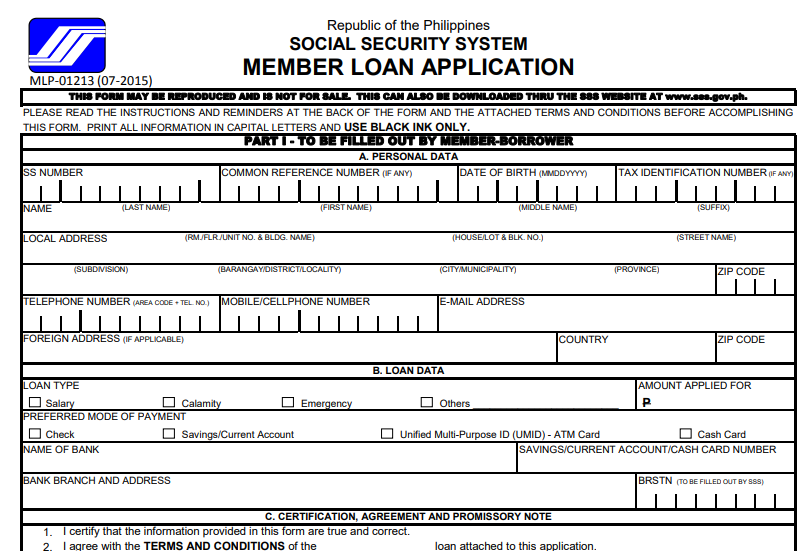

Visit an SSS branch and submit a dully filled up application form that you can download from the SSS website to apply personally together with your SSS ID or E-6 Form if you do not have a UMID yet. ALso, you must have at least two valid IDs with your signature with one having your photo.

A different set of requirements for applications whether the borrower will go to the SSS branch or an authorized representative will do it. At the SSS Salary Loan guide, you can check the accepted IDs and other requirements.

It will take three weeks to more than one month of salary loan processing after submitting all the requirements. If you are a full-time employee, you can get your loan check from your employer. You need to pick it up from the branch if you are self-employed.

Filling an Application at the My.SSS

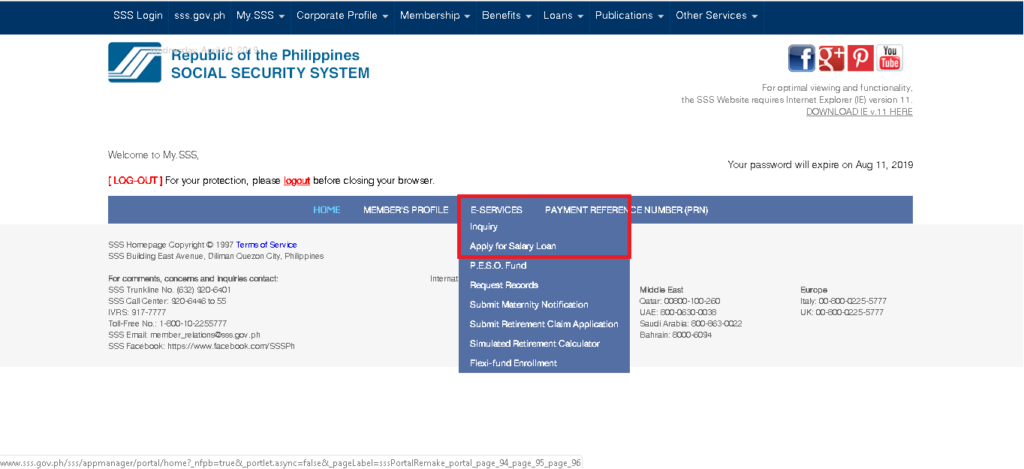

You can apply for a salary loan online through the My.SSS portal if you are registered on the SSS online website.

You can do the following steps upon registration and verification of your account:

Log-in your account at their My.SSS Online portal

click on E-services at the second navigation bar at get the drop down options. Choose Apply for Salary Loan to proceed with the application.

You can choose how much you want to loan. On my case I choose the maximum loan that is available for my account. Because of that I can’t show you another screenshot on what it looks like. Just bare in mind that the drop down menu will only display available options based on your employment tenure and the number of contributions you have in your SSS account.

After that, re-confirm your application by providing postal code and mailing address where you want your check to be sent.

The HR department will get a message regarding your loan application through their My.SSS account and they must approve your application before it gets processed. But just to make sure, notify your HR department that you filed an application for an SSS Salary loan.

Usually the check will arrive at the mailing address you indicated with a stub that you must present to your HR Department if you are employed. In my case, our HR department handed it to me when I visited our main branch.

Remember to enchash it within 3 months from issue date at any Landbank branch or you may deposit it your your bank account (any bank will do as long as you deposit the issued check), otherwise, it would be void.

If you are an OFW or Overseas Filipino Worker, you can also apply a salary loan. Simply go to the SSS Representative Office located in selected countries. However, if there is no SSS office in your location, you can always authorized someone in the country to file on your behalf. To avoid delays in processing the loan, employees should make sure that their employer submits an updated SS Form L-501, which is a Specimen Signature Card. It must be updated yearly.

Be the first to comment