Time will come that we will not be able to work anymore not because we do not want but because we are not well-conditioned anymore in terms of physical aspects. Good thing SSS created a way to give back to its member who already tired. They will be able to receive a pension from SSS. If you are a member and you wanted to know how much you will receive here’s a SSS Pension Computation guide for you.

SSS OIC Aurora C. Ignacio said “It is high time to adjust the contribution rates and monthly salary credits of SSS to allow members to save more for their retirement” In addition, RA 11199 or the Social Security Act of 2018 has increased the monthly contribution and make it by 12% to provide better benefits for SSS members and better pension to retired SSS members.

Requirements Of SSS Pension:

- UMID ID, SSS ID

- Two valid IDs with photo and signature

- Photo and Signature Card with 1 x 1 photo and fingerprints

- Photocopy of Passport and debit or cash card

- Completed Retirement Claim Application (RCA) Form or Application for DDR Benefit Form

Ways To Qualify For Retirement Benefits:

SSS pension is a fund that you will receive once you can no longer anymore because of your age or simply means when you get old. You can get your pension at any SSS branch.

- Must be an SSS member

- Aged 60-65

- Have paid at least 120 monthly SSS contribution prior to retirement semester

- Separated from employment / stopped being self-employed or employed / not employed

Steps On How Will You Recieve Your SSS Pension:

- SSS will require you to open a savings account at any bank

- SSS will ask you to provide a photocopy of your ATM card, initial deposit slip, bank statement and passbook

- You can choose if you want to receive it in a Monthly Pension (Will apply once you applied for your retirement benefit) or Lump Sum Payment (You will receive the first 18 months of your pension at a discounted rate)

Additional Benefits Aside From Your Pension From SSS:

- If you reach 65 years old you will be a Philhealth member automatically if you are not a member yet

- Philhealth Hospitalization Benefits For You and Your Dependents

- Dependents allowance for up to 10% of your pension (5 Children only up until they reach 21 years old)

- 13th-month pension every December

- Upon your death, your primary beneficiary will receive 100% of your pension

Ways To Compute Your SSS Pension:

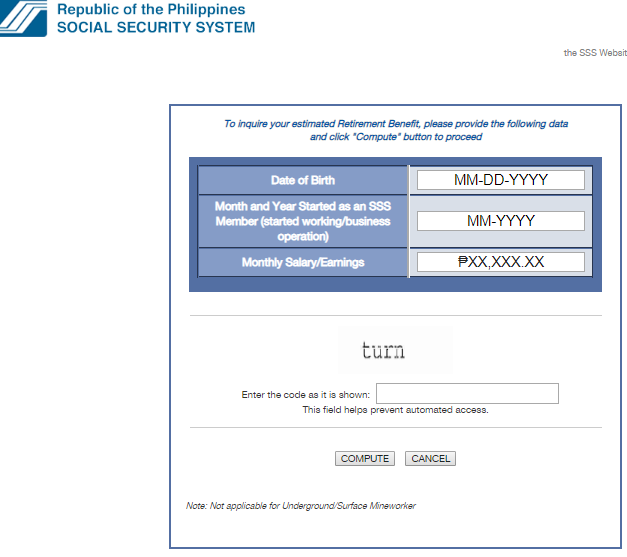

- Online SSS Pension Calculator

Visit SSS Retirement Benefit Estimator, fill-up the form and then click “Compute”. SSS Estimator will show you two sets of monthly pension amounts: one for when you retire at 65 and one for when you retire at 60. The pension will be higher if you choose retirement at age 65.

- Manual SSS Pension Computation

In 2017, President approved that retirees will be entitled to a pension increase of Php 1,000.00. However, the pension will also depend on the amount of your paid contributions, the number of years as a member and the number of your minor dependents. You can use either of these 3 formulas to compute your pension.

1. Monthly Pension Php 300 + 20% of average monthly salary credit (AMSC) + 2% of AMSC for each credited year of service (CYS) in excess of ten years + PHP 1,000

2. PHP 1,200 if CYS is between 10-20 years; PHP 2,400 if CYS is 20 years or more + PHP 1,000

3. 40% of the average AMSC + PHP 1,000

Possible Deductions in Retirement Benefits:

- Unpaid SSS loans

- Partial disability benefits

- Overlapping SSS sickness

- Overpaid pension due to dependent’s death, employment, or marriage

Getting older is never easy, so plan for your retirement. It is better to be prepared than to regret and one step of preparing is familiarizing yourself with the basic SSS pension computation.

More Helpful Articles About SSS:

Guide on How to Apply for a Salary Loan

How To Apply For A Calamity Loan

SSS Calamity Loan Online Application | Loan up to Php 20,000

SSS Will Give Php 20,000 Cash Benefit to Those Who Lost Their Job

Be the first to comment