We, Filipino Employees, can decide whether we like to continue or resign from our current job. Regardless of the reason why we wanted to resign, as long as we do it properly there’s a big chance that you will get your back pay. So it is important to know how to compute back pay, so you’ll be able to know how much you will receive.

But before thinking about resigning from your current job, please do note that it is hard to find a job at this time due to the high volume of job hunters, so be thankful if you have a job that suits you well and you enjoy too. Unless, if you’re resigning because of bigger opportunity or health reasons then that is understandable.

So if you are planning to resign, then this might help you. Learn on how to compute your back pay, so that you know how much to expect.

What is Back Pay and What Does it Include?

Back pay is the amount of salary and other benefits that an employee claims after resigning from a company.

Back pay includes:

Last Salary

This is composed of the number of days that an employee has rendered after filing a resignation. Some company usually gives 30 days rendering time, but it may vary depending on the company.

Tax Refund

Every employee receives their tax refund every one year, so if you’re resigning already, this will also be included in your backpay since you will already be separated from that company already.

Prorated 13th Month Pay

Every employee is required to receive a prorated 13th-month pay from their company, even if you’re already resigning from your company you’re entitled to receive it.

13th-month pay includes:

-Maternity Leave

-Sick Leave

-Vacation Leave

-Basic Pay

If you want to know how is the computation of your 13th-month pay, check this guide: How to Compute 13th-Month Pay

Here’s How to Compute Your Backpay:

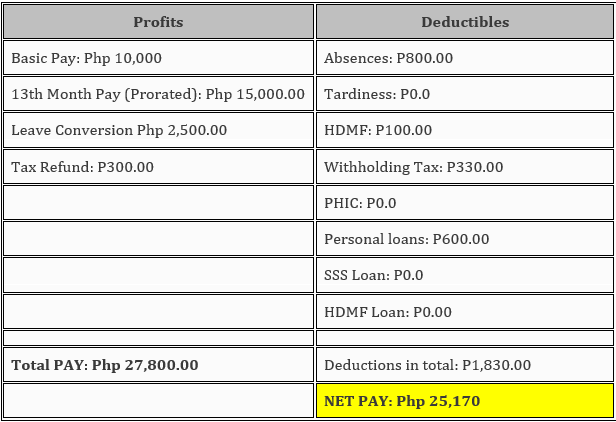

(See the example below)

That is an example of how back pay is computed.

1: Add all the profits (Take note of the total)

2: Add all the Deductible (Take note of the total)

3: Subtract the total amount of Profit and Deductibles

The Total Subtracted Amount Will Be Your Back Pay.

As you can see in the detail listed even the absences and tardiness is included. So it is really a good thing if you don’t have any absences and tardiness so that there will be no big deduction on your backpay.

Usually, the employee will receive her/his backpay 30 up to 60 days upon resigning but there are companies who wait for the requirement first before they start processing the backpay, and for you to know that, please get in touch with you HR Department.

Be the first to comment