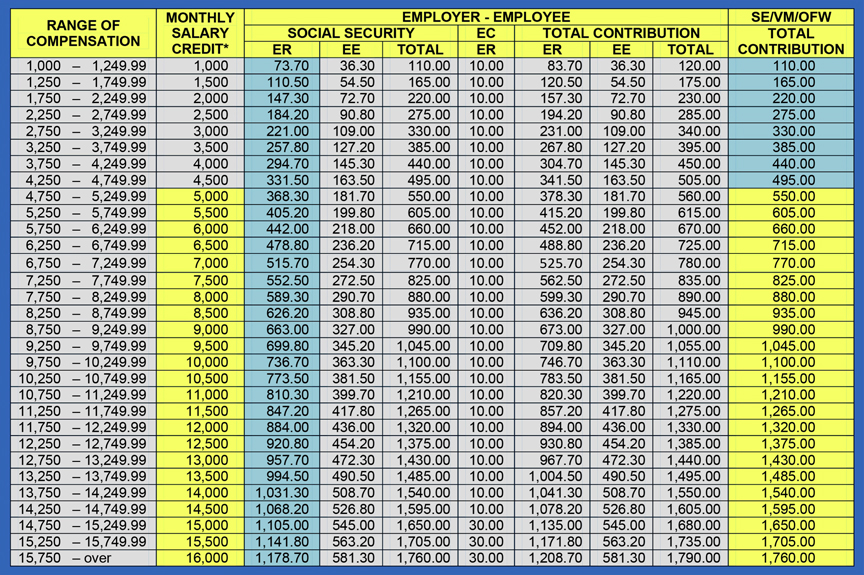

SSS contributions are required by law for privately employed individuals. Each month, employer will deduct 3.36% from your basic salary. Upon payment to SSS, employers will then add an amount equivalent to 7.37% of your basic salary. Your total contribution will now become 11%. However, maximum salary credit is only at P16,000.

Overseas Filipino Workers and Self-Employed are classified as voluntary members. There contribution is 11% of their total monthly income. Note that the minimum salary for voluntary members is P5,000.

For a more detailed list, please see table below:

There is a proposed bill to increase contribution from 11% to 12.5%. Maximum salary credit is also set to increase to P20,000 if the bill passes. For the meantime, the prevailing rate of 11% is still applicable.

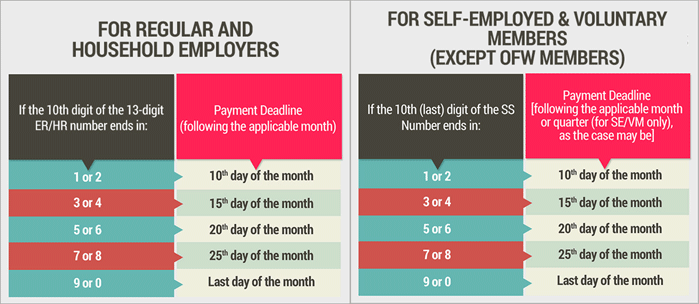

There also a deadline for submitting contributions. Please see schedule below:

SSS is imposing penalties to late payments so make sure to pay on time to the SSS Office or their designated payment centers. Also, make sure that your employer is paying for your SSS on time.

Be the first to comment